nh property tax calculator

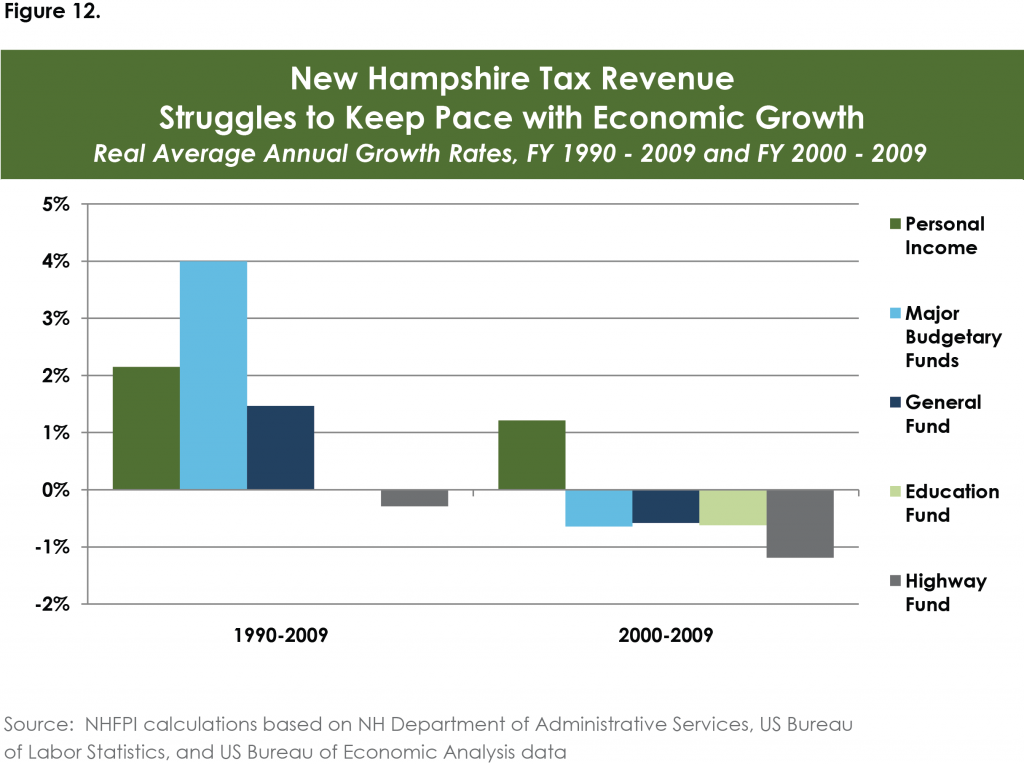

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. New Hampshire Property Taxes Go To Different State 463600 Avg.

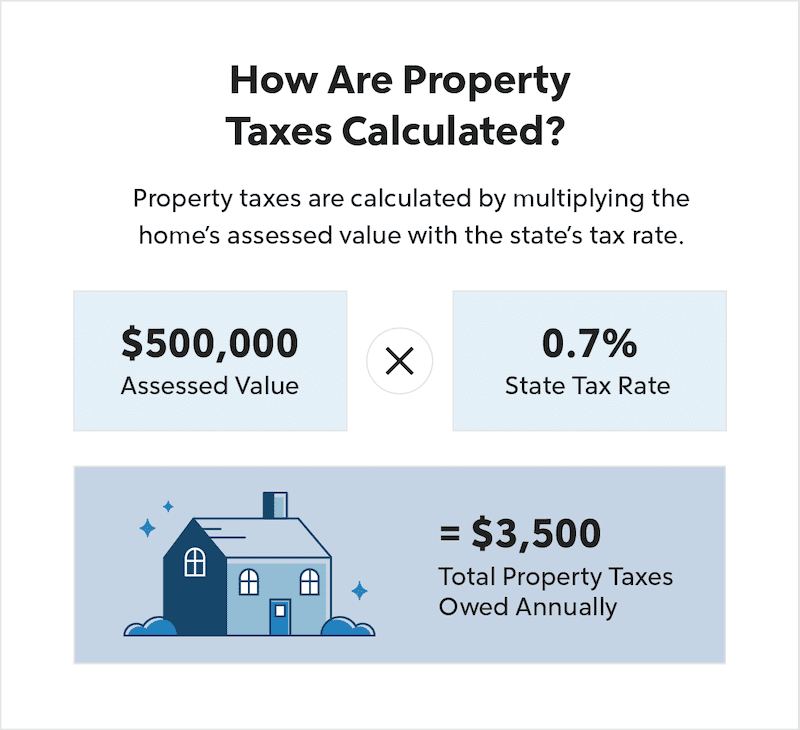

The assessed value of the property 2.

. 2013 City of Concord NH. The assessed value multiplied by the. The median property tax on a 30680000 house is 533832 in Rockingham County.

The median property tax on a 30680000 house is 570648 in New Hampshire. Assessing Tax Calculator The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. Online Property Tax Calculator Enter your Assessed Property Value in dollars - Example.

The local tax rate where the property is situated 300000 1000 300 x 2306. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090.

Get the inside scoop on what its. Only on income from. Assessing department tax calculator.

Property Tax Information Real Estate Tax Rate The current real estate tax rate for the City of Franklin NH is 2321 per 1000 of your propertys assessed value. Comma separated values csv format. Property Tax by County Property Tax Calculator REthority from.

Your average tax rate is 1198 and your. Enter as a whole number without spaces dollar sign or comma. Get the inside scoop on what its.

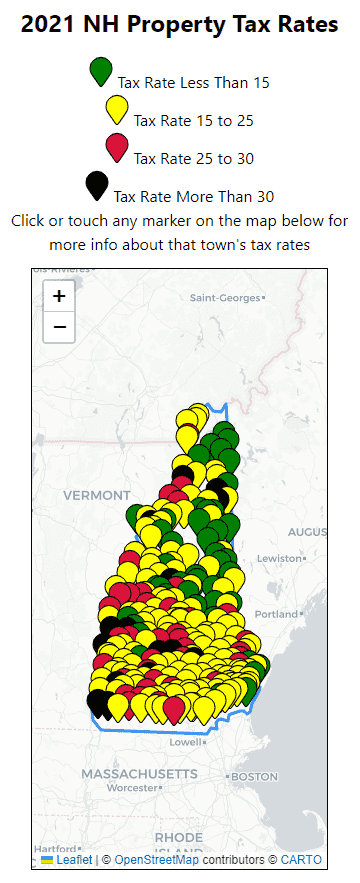

Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. The median property tax. New Hampshire Income Tax Calculator 2021.

The median property tax on a 24360000 house is 470148 in Merrimack County. Comma separated values csv format. Property Tax by County Property Tax Calculator REthority from.

U Unincorporated How to Calculate Your NH Property Tax Bill 1. Use SmartAssets New Hampshire paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. The assessed value multiplied by the tax rate equals the.

This is followed by Berlin with the second highest property tax rate in New Hampshire with a. Nh Property Tax Calculator. In this guide well deep dive into taxes in New.

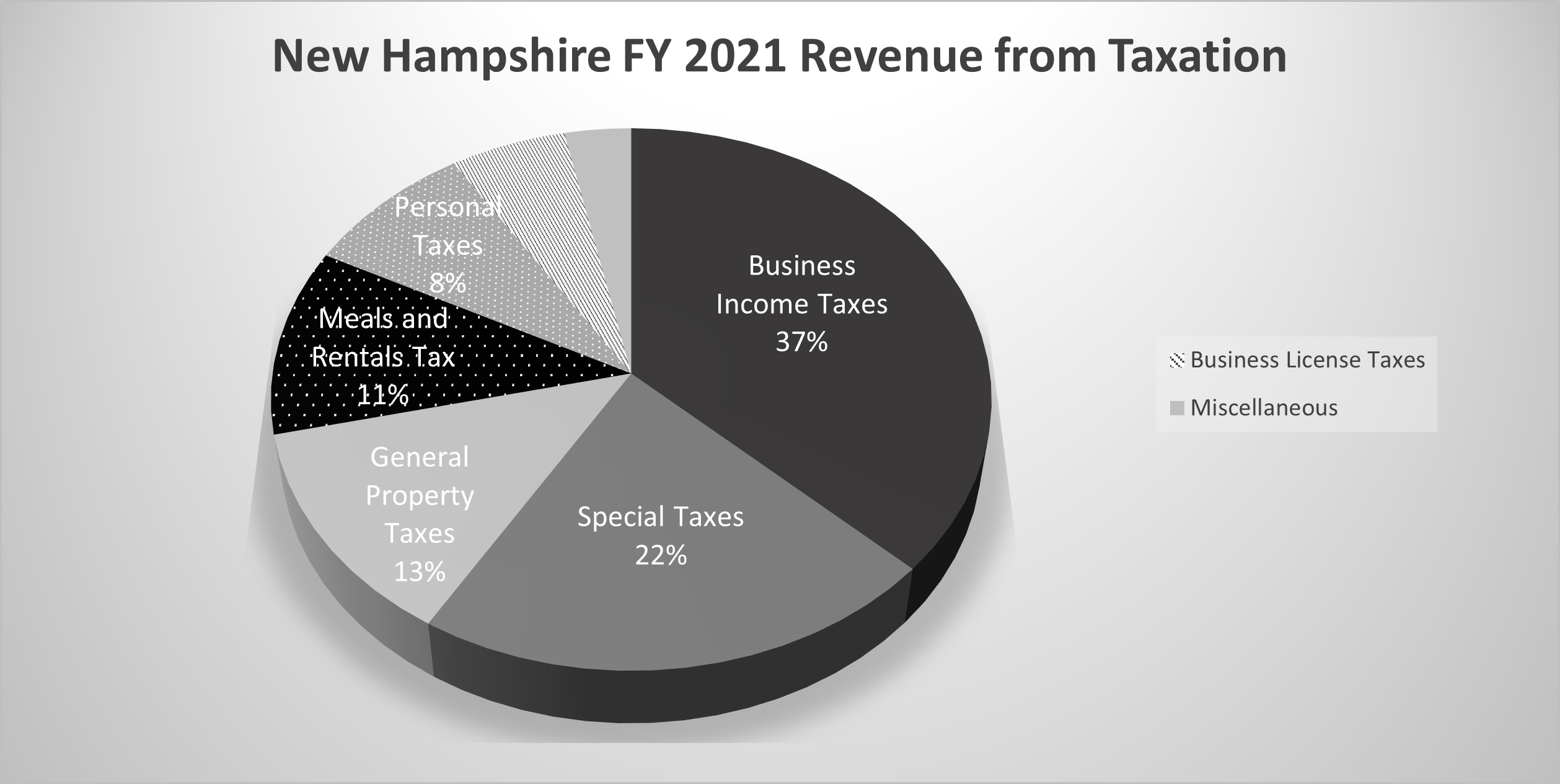

Estimate Property Tax Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden. New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Interest dividends Sales tax.

186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per. All documents have been saved in Portable Document Format unless otherwise. The median property tax on a 24360000 house is 453096 in New Hampshire.

Nh Property Tax Calculator.

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Property Taxes Going Up In Concord Penacook Concord Nh Patch

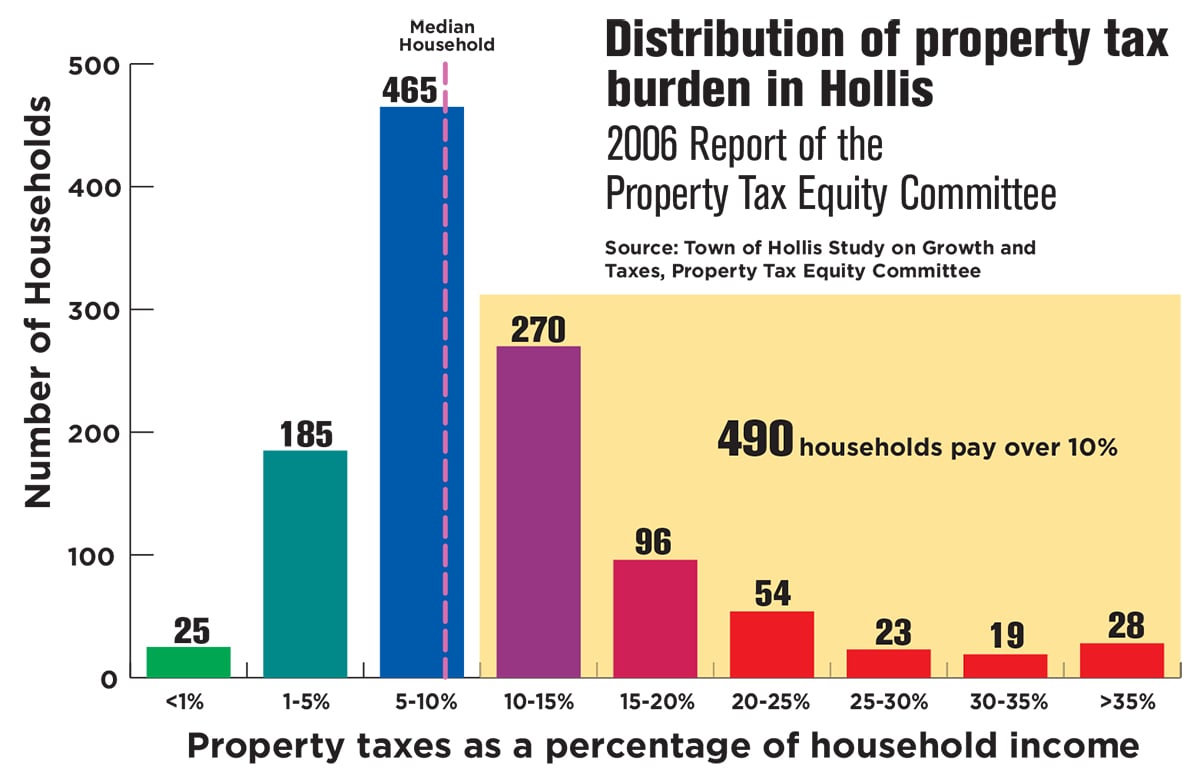

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

2021 Tax Rate Press Release The Town Of Seabrook Nh

Online Property Tax Calculator City Of Portsmouth

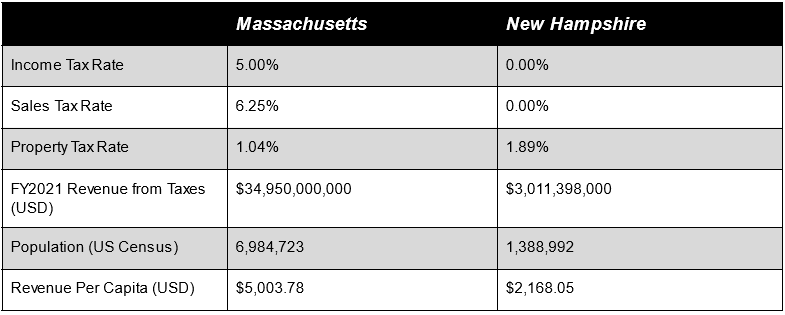

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Business Nh Magazine Nh Named A Most Tax Friendly State

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

Property Tax Is Biggest Burden For Nh Businesses Nh Business Review

Real Estate Taxes Vs Property Taxes Quicken Loans

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News